Our sweet spot is:

- Mods 1.30 - 3.00

- Full time employees making an average of $ 24,000 a year (seasonal and part timers hurt this)

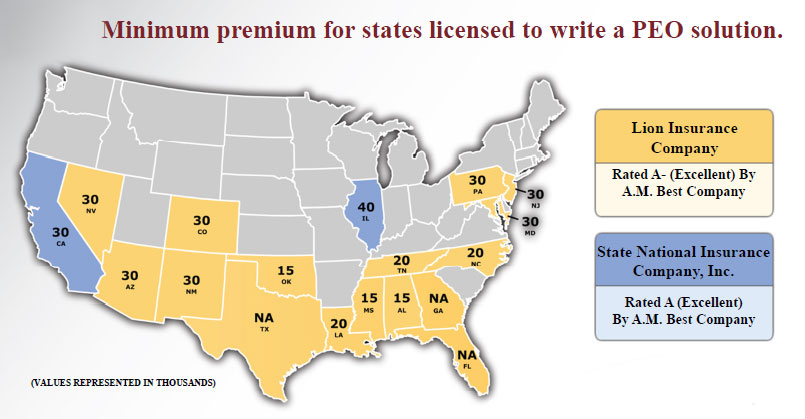

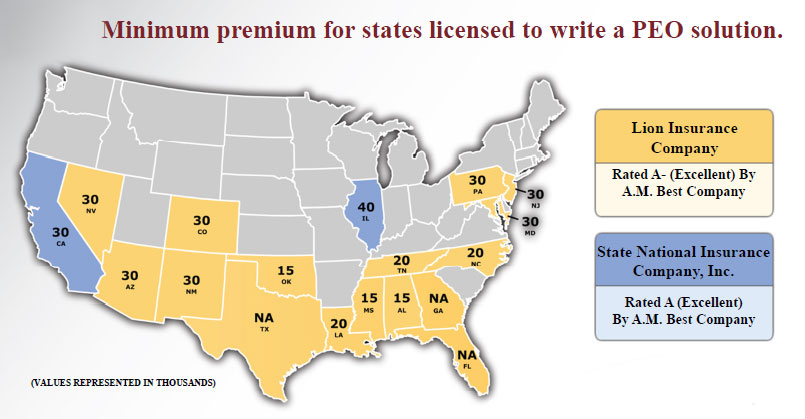

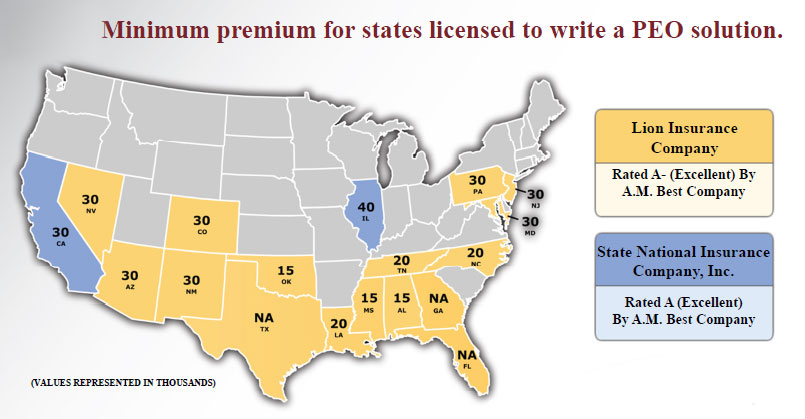

- Codes with pool rates over $9.00/$100. Here are the state minimum premiums:

This PEO does, but some do not.

Yes, most states regulate them closely, requiring financial reports up to quarterly, actuarial reports at least annually, and a bond.

No. The client is assigned their own policy # and losses are

reported to the WCRB and the clientís x-mod is maintained.

Yes. The PEO stops charging taxes once the required threshold are met.

Yes. Itís part of the service and it is required.

The PEO only.

Phone or Online.

Weekly, Bi-Weekly are the most typical pay schedules.

If payroll is scheduled for a Friday, the client must call in

their hours by Tuesday before 12 PM PDT. The payroll wages,

taxes, fees, and workers comp premiums must be funded via

inter-bank transfer or wire transfer by 2PM Wednesday. The

payroll reports and checks will be delivered by UPS on Friday

before noon. If checks are needed before Friday and or direct deposit of

monies into employee bank accounts is chosen, then the

process must begin on Monday.

Brokers have placed 600+ accounts and over $60,000,000 in Workers Comp premiums into this unique program over the past 2 years. And 85% of those accounts were written by non-incumbent agents.

<< Back to FAQ